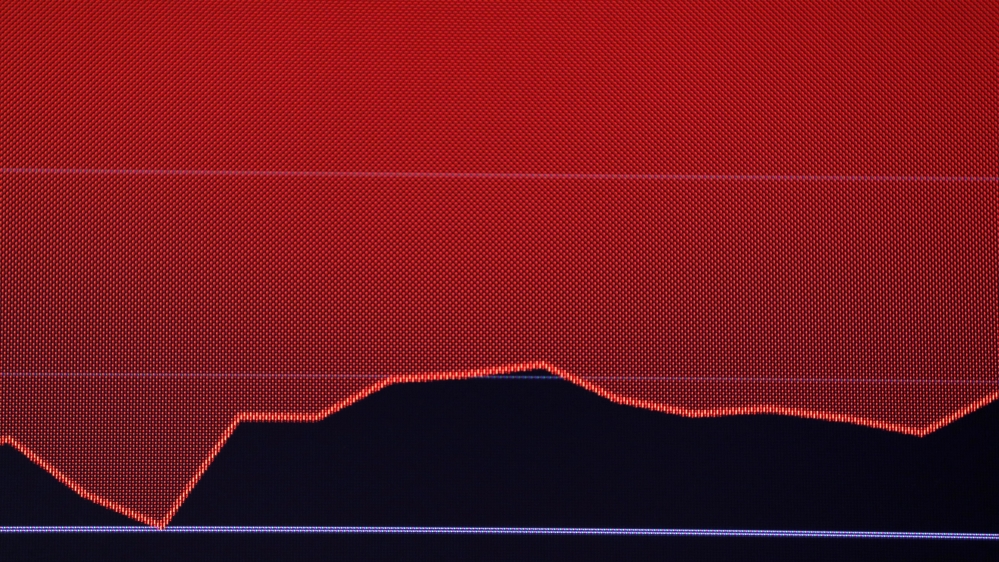

United States stocks sold off sharply on Thursday. As large swings in the market continued due to uncertainty over the spread of the coronavirus and its economic fallout, shares of banks and travel companies lost value.

The Dow Jones Industrial Average fell 969.17 points, or 3.58 percent, to 26,121.69. The S&P 500 lost 105.98 points, or 3.39 percent, to 3,024.14. The Nasdaq Composite dropped 279.49 points, or 3.1 percent, to 8,738.60.

Investors are growing increasingly worried that the spreading coronavirus will hit US corporate cash flow and credit in some sectors, especially if the outbreak keeps workers at home or prevents companies from paying employees.

US corporate debt is near all-time highs, as is the size of the so-called triple-B segment of the market - companies one notch above junk status. Sudden shocks to the economy disrupt cash flow and put companies at a greater risk of downgrade.

"This is altering people's travel plans and work schedules," said Brian Reynolds, chief market strategist at Reynolds Strategy. "You could see defaults pick up because a slowing of economic growth. If you see what's happened to credit spreads, that has already discounted some modest increase in defaults."

Corporations around the world have begun issuing profit warnings and curbing activities, as more than 96,500 people have been infected by the coronavirus globally, and over 3,300 people have died, according to a Reuters tally. The US death toll stands at 11, in Washington State and California. New York's governor said on Thursday that 22 people in that state have the virus.

Junk bonds are pricing in a higher level of default, and spreads over safer Treasury bills have widened to 475 basis points from 403 at the start of February, indicates data from the ICE/BofA high yield index. February's widening was the largest the index has seen since December 2018.

A shutdown of parts of the Chinese economy has created problems for US companies dependent on the country's production and consumption. But as the outbreak spreads, reduced economic activity in the US could also become a factor. Various investors and market watchers are now cautioning about the risk to credit markets if the virus causes a significant slowdown to the economy.

Macro advisory firm Exante Data on Monday warned that banks may be reluctant to refinance loans to companies if creditworthiness is deteriorating rapidly.

Mohamed El-Erian, the chief economic adviser at Allianz and a widely followed economist, noted in a column in the Financial Times earlier this week that there is a "large amount of US investment-grade corporate debt that hangs over the high-yield market like a Damocles sword".

"Much of it is now facing a considerably higher risk of downgrade, given the inevitable global economic slowdown caused by coronavirus," wrote El-Erian.

At-risk sectors

Ratings agencies Moody's, S&P and Fitch have all said that the coronavirus poses risks to US companies' earnings and cash flow, citing in particular sectors dependent on discretionary consumer spending and global supply chains.

On the front line have been sectors affected by reduced tourism: airlines, hotels, cruise companies and casinos, which Fitch said could see a material reduction in cash flows in the event of a severe pandemic.

The global automotive industry is also expected to suffer from the one-two punch of slowdowns in Chinese consumption and production, with the greatest impact on the sector likely to come from reduced sales during the outbreak, according to Fitch Ratings.

Lower Chinese demand for commodities is expected to hit US energy companies, in particular US liquid natural gas producers, who already face some stress. US chemical companies will also see lower earnings, Moody's said, especially those with significant sales and production in China.

Other industries cited include US toymakers, payments firms, and luxury brands.

Airlines around the world have been cancelling flights and warning of a hit to profitability. The United Kingdom's Flybe collapsed on Thursday after a plunge in travel demand.

Credit default swaps, which measure the cost to insure a company's debt, have risen for Delta Air Lines, United Airlines and American Airlines, although they are still far off levels that would be considered indicative of potential default.

"If you're a company that is not fine starting out and you're already exposed, that's where you're starting to see some big cracks," said Joseph Lind, senior portfolio manager for non-investment grade credit at Neuberger Berman in Chicago.

Among those are exploration and production companies in the energy sector.

"The bonds that have been issued this year have performed pretty terribly," Lind said. "I think we will see a rise in defaults."

SOURCE: Reuters news agency