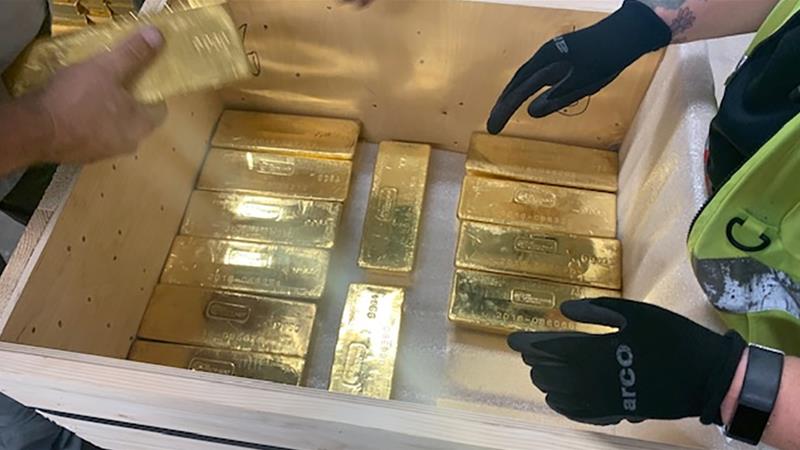

News of United States air attack killing Iranian general helps gold build on its biggest annual gain in almost a decade.

Gold advanced toward a six-year high after a U.S. airstrike killed one of Iran’s most powerful generals, ratcheting up tensions in the Middle East and driving demand for havens.

Bullion rallied as much as 1.5% to $1,551.52 an ounce in London, reaching the highest since September. Platinum futures topped $1,000 an ounce to reach the highest since early 2018, while silver and other haven assets including the yen and Treasuries also rose.

The strike in Baghdad ordered by President Donald Trump killed Qassem Soleimani, the Iranian general who led the Revolutionary Guards’ Quds force. Iran’s supreme leader vowed “severe retaliation.” The news helped gold to build on the biggest annual gain in almost a decade, a rally that was driven by a weaker dollar, lower real rates and geopolitical concerns.

“Today’s event has probably only brought forward the inevitable test of the September high,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “Rising inflation concerns through higher input prices -- oil and food -- combined with geopolitical uncertainty is a potent cocktail which supports a market already on the move.”

Gold was up 1.1% at $1,546.22 by 7:36 a.m. in New York, taking this week’s gain to 2.4%, the most since August. The metal jumped 18% last year.

Last year’s advance marked a positive shift in investor attitude toward gold, according to RBC Capital Markets, which predicted further gains this year and next. Goldman Sachs Group Inc., Citigroup Inc. and UBS Group AG have said they’re looking for $1,600 an ounce.

January is historically gold’s best month, according to Bloomberg Intelligence, with an average advance of 2.7% over the past 20 years. The metal will approach $1,600 by February if it matches the 5.2% average increase of the past five years.

Still, geopolitics typically don’t have a lasting impact on gold unless broader consequences for the economy or financial markets arise, said Carsten Menke, an analyst at Julius Baer.

Next up for investors is the latest reading on the health of the world’s biggest economy, with U.S. ISM manufacturing data and minutes from the Federal Reserve’s last policy-setting meeting due later on Friday.

Other precious metals

Platinum futures climbed as much as 1.7% to $1,001.40 an ounce in New York, reaching the highest for a most-active contract since February 2018, before paring some gains.

Spot silver gained 0.8% to $18.1592 an ounce and palladium also advanced.

SOURCE: Bloomberg